updated the 28.04.2025

Understanding the EU Taxonomy for Sustainable Activities

Does the EU Taxonomy for Sustainable Activities affect your company?

As mentioned earlier the EU Taxonomy isn’t a report regulation itself, but it is a more general framework regulation that affects how you should report. This means that it applies for you, when you have to start reporting, which you can read about here.

Read below to understand how to incorporate the EU Taxonomy into your daily operations.

How to work with the EU Taxonomy for Sustainable Activities?

If you have to report

To align with the EU Taxonomy, it's crucial first to understand and document all your annual economic activities, including both internal and external investments.

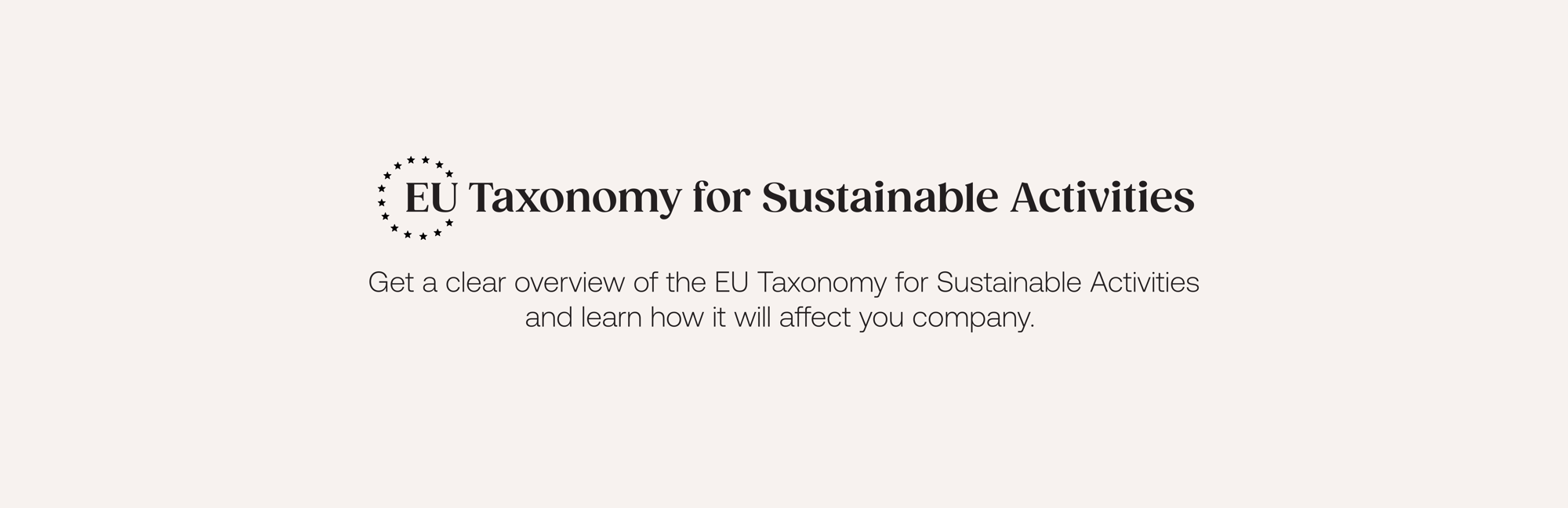

Once these activities are identified, you can begin classifying them according to the EU Taxonomy framework, which consists of six environmental objectives. Each investment should be assessed for its contribution to at least one of these objectives while ensuring it does not harm any of the others and complies with minimum social standards.

Although the EU Taxonomy itself is not a reporting regulation, it provides the criteria that inform sustainability reporting. Therefore, it's beneficial to consider these objectives when planning future investments to ensure they align with the framework's sustainability goals.

If you don’t have to report?

Although you don't need to align with the EU Taxonomy framework immediately, it's still important to start preparing. Begin by understanding all your annual economic activities, including both internal and external investments. Additionally, it's wise to proactively consider the six environmental objectives before making investments, to make it easier to classify them, when you have to start reporting.

How is the EU Taxonomy for Sustainable Activities connected to other initiatives, regulations and laws?

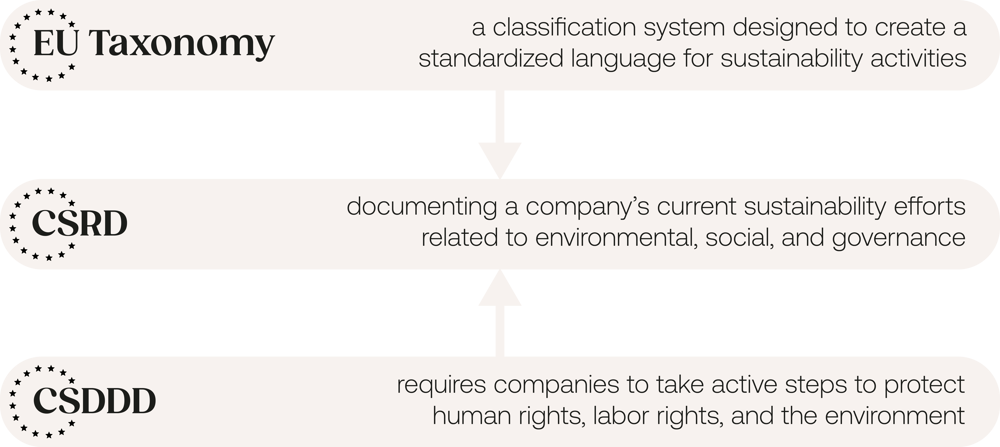

The EU Taxonomy is the regulation that sets the language for the Corporate Sustainability Reporting Directive (CSRD), which means it provides the criteria and definitions that you must use when working on your sustainability reporting. This ensures consistency and clarity in how environmental and social impacts are measured and disclosed across the EU.

The EU Taxonomy is also closely connected to the Corporate Sustainability Due Diligence Directive (CSDDD). While the EU Taxonomy sets the criteria for what qualifies as a sustainable economic activity, the CSDDD requires companies to take active measures to manage and reduce their impacts on human rights and the environment throughout their operations and supply chains. The CSDDD establishes minimum safeguards that companies must meet under the EU Taxonomy, such as ensuring compliance with human rights, labor rights, and anti-corruption standards.